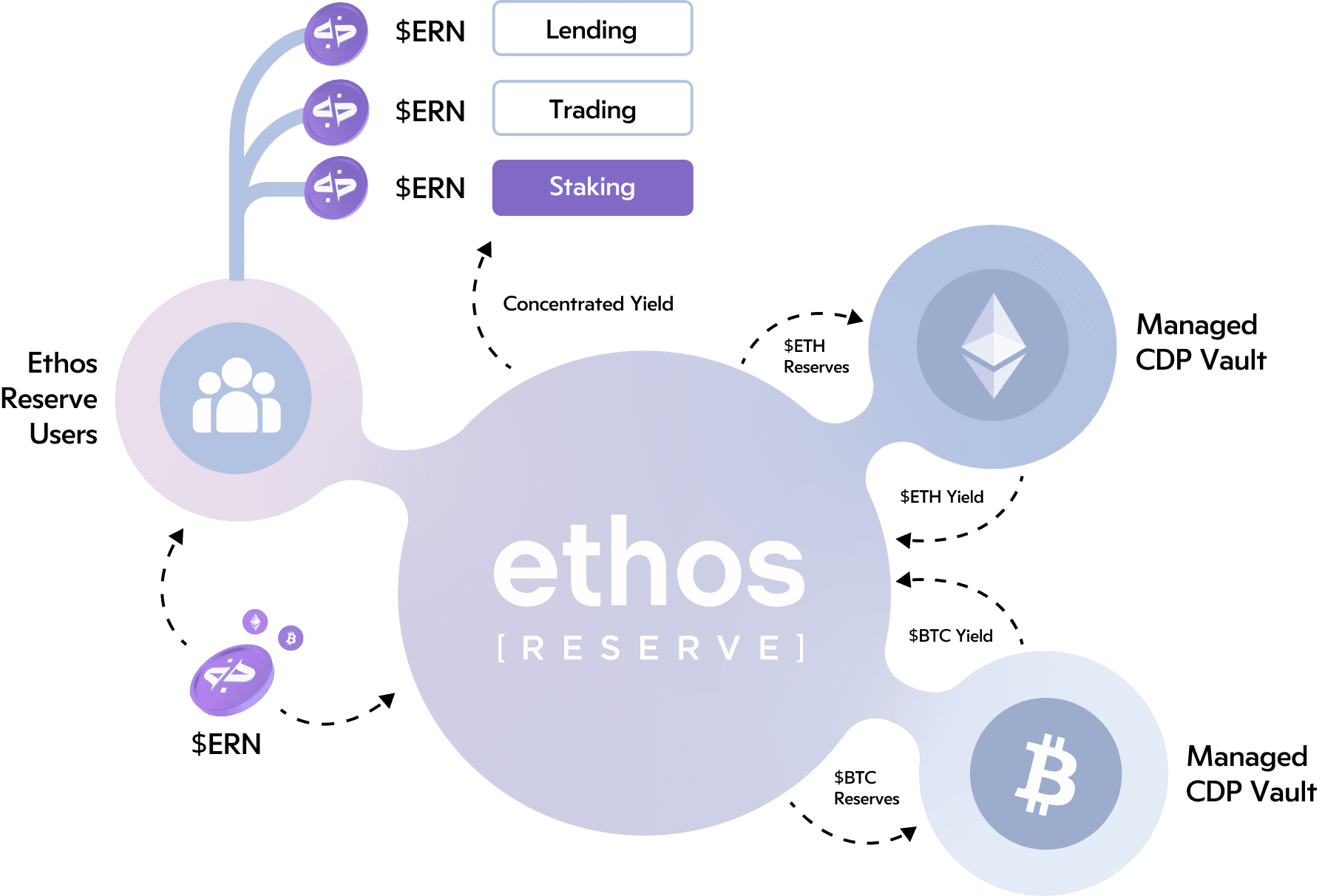

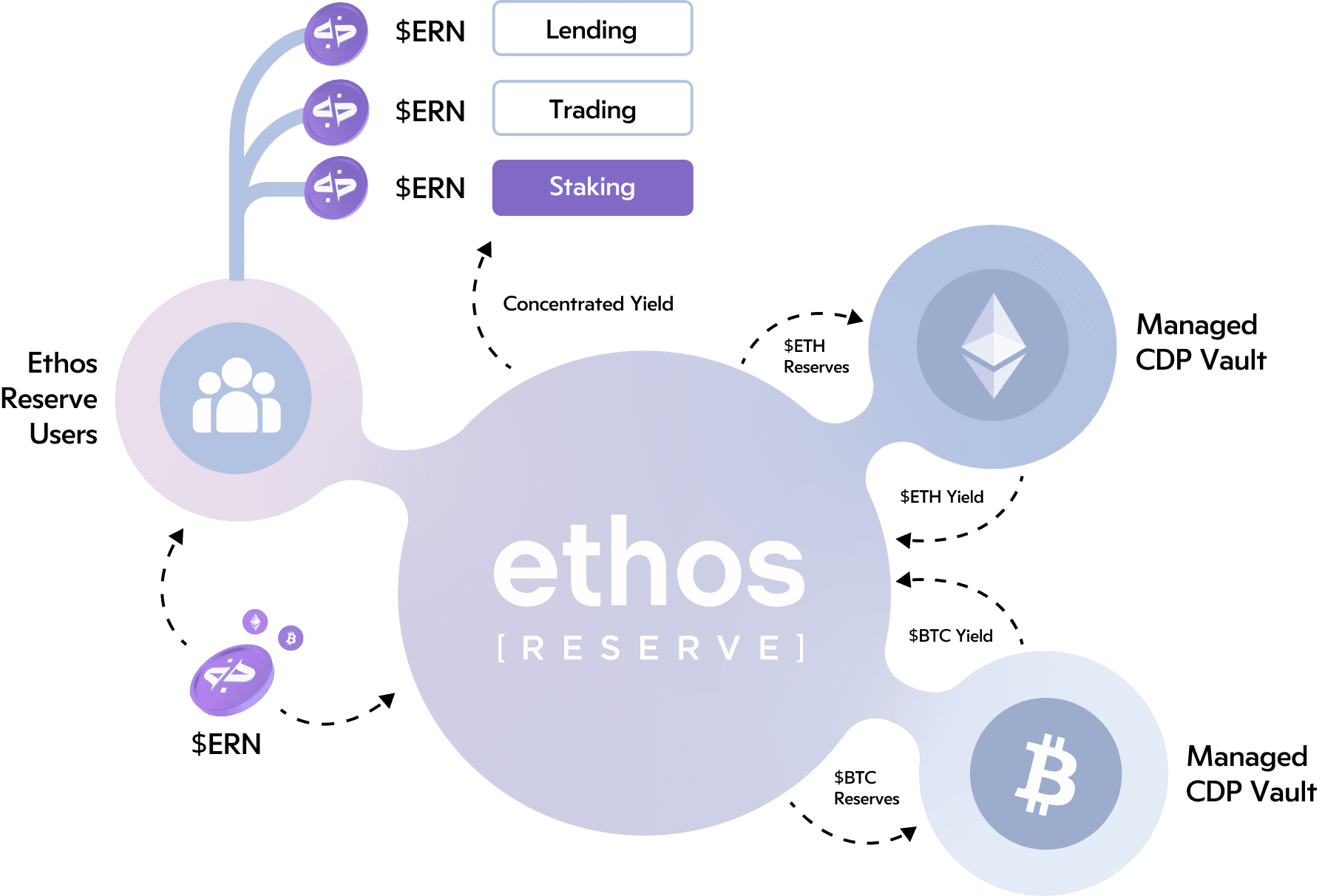

Simply put, Ethos Reserve is a Collateralized Debt Position (CDP) protocol on the Optimism network, offering decentralized lending that allows users to take out interest-free loans against collateral. In this article we will dig into this concept in greater detail, and explain what Ethos Reserve is capable of.

In Decentralized Finance (DeFi) the term ‘Collateralized Debt Position’ refers to the position created by locking collateral in a smart contract to generate some kind of debt. In the case of Ethos Reserve, users can deposit ETH, BTC, and OP, and mint the Ethos Reserve Note (ERN) stablecoin. Deposited assets are held as collateral and debt is issued. ERN can then be used freely throughout DeFi, like any other asset.

CDPs like Ethos Reserve allow users to access the value of their assets without selling them. Consider a user that has 1 BTC, and wants to leverage $1,000 of that value for some venture.

Via Ethos Reserve, they can collateralize their BTC, mint 1,000 ERN, and conduct business with their ERN. Later, they can repay their 1000 ERN debt and recoup their 1 BTC, having never sold it. This provides capital and tax efficiency, and introduces new layered, leveraged investment strategies.

ERN represents the system’s debt, so safeguarding its value is of the utmost importance. Primary and secondary oracles monitor the value of collateral, and of ERN, against the US Dollar, so values are known and current at all times.

Advanced liquidation mechanics ensure that the value of each collateral backing system debt remains above a safe threshold. These thresholds and tail risks are monitored closely on- and off-chain. These liquidation mechanisms are enforced through the Stability Pool, where users can stake their ERN.

When collateral is liquidated, ERN from the Stability Pool is burned and collateral is distributed to Stability Pool providers. The liquidation thresholds ensure that this is always profitable for Stability Pool providers at the time of liquidation.

In essence, providers settle the debt using their staked ERN from the Stability Pool. In return, they obtain collateral that was liquidated at a value higher than the debt they covered, effectively allowing them to acquire the collateral at a reduced price

If the Stability Pool is empty, the system uses a secondary liquidation mechanism called redistribution. In this case, Ethos Reserve redistributes the debt and collateral from liquidated positions to all other existing positions. The redistribution of debt and collateral is done in proportion to the recipient collateral amounts. This transfers the risk to the users instead of the protocol, making Ethos Reserve extremely resilient.

There are two notable reasons why Ethos Reserve will outperform.

- Ethos Reserve has a unique ability to rehypothecate collateral and generate safe yield with minimal risk. This yield is directed to the stability pool, meaning that out of all existing CDPs, Ethos Reserve is the only one that can perpetually incentivize the Stability Pool regardless of market conditions. ERN will always generate yield, no matter what.

- Ethos Reserve has leveraged Reaper technology to develop the staked ERN (stERN) vault. This vault automatically compounds the Stability Pool into more ERN. While some users want liquidated assets at a discount, others might not want the volatile asset price exposure, so the stERN vault sells liquidated collateral for more ERN. The vault also issues interest-bearing stERN tokens to depositors, who can trade their positions freely, provide liquidity, or store them in a cold wallet.

These two features combined mean that users will always have access to volatile asset yields, and stable asset prices, making the case for Ethos Reserve unparalleled.

Absolutely. ERN and stERN are liquid and available through markets on chains such as Optimism, Arbitrum, and more. Since ERN is soft-pegged to $1, we often see it trading at a slight premium (around $1.03). While you can buy it on exchanges, the most efficient way to access ERN is to open a position on Ethos Reserve and mint your own. Since the system values it at $1, arbitrage opportunities are abundant.

The Ethos Reserve codebase is extremely versatile and can be refactored to achieve a myriad of outcomes. Adding or removing collateral types like Liquid Staking Tokens or Real World Assets (RWAs), and introducing UX features like one-click leverage, are entirely within scope. The Ethos Reserve codebase can be adapted to any use case, on any chain, and maintain its performance edge with asset management and on- and off-chain infrastructure.

Ethos Reserve is a decentralized lending protocol that allows users to take out interest-free loans against collateral such as BTC and ETH. Loans on Ethos Reserve are paid in Ethos Reserve Notes (ERN), a stable asset pegged to the US Dollar. Collateral backing ERN is used to generate passive yield, which is directed toward Stability Pool depositors. These depositors secure the protocol against unhealthy collateral by depositing their ERN tokens into a pool which liquidates unhealthy positions within the system.

Ethos Reserve is a decentralized lending protocol that allows users to take out interest-free loans against collateral such as BTC and ETH. Loans on Ethos Reserve are paid in Ethos Reserve Notes, or ERN, which is a stable asset pegged to the US Dollar.

Loans drawn from Ethos Reserve require users to maintain a minimum amount of collateral in the system to cover their debt. These collateral ratios are as low as 108% for ETH, 110% for BTC, and 115% for OP, and may be lowered over time depending on usage.

Collateral backing ERN is used to generate passive yield, which is directed toward Stability Pool depositors. These depositors secure the protocol against unhealthy collateral by depositing their ERN tokens into a pool which liquidates unhealthy positions within the system.