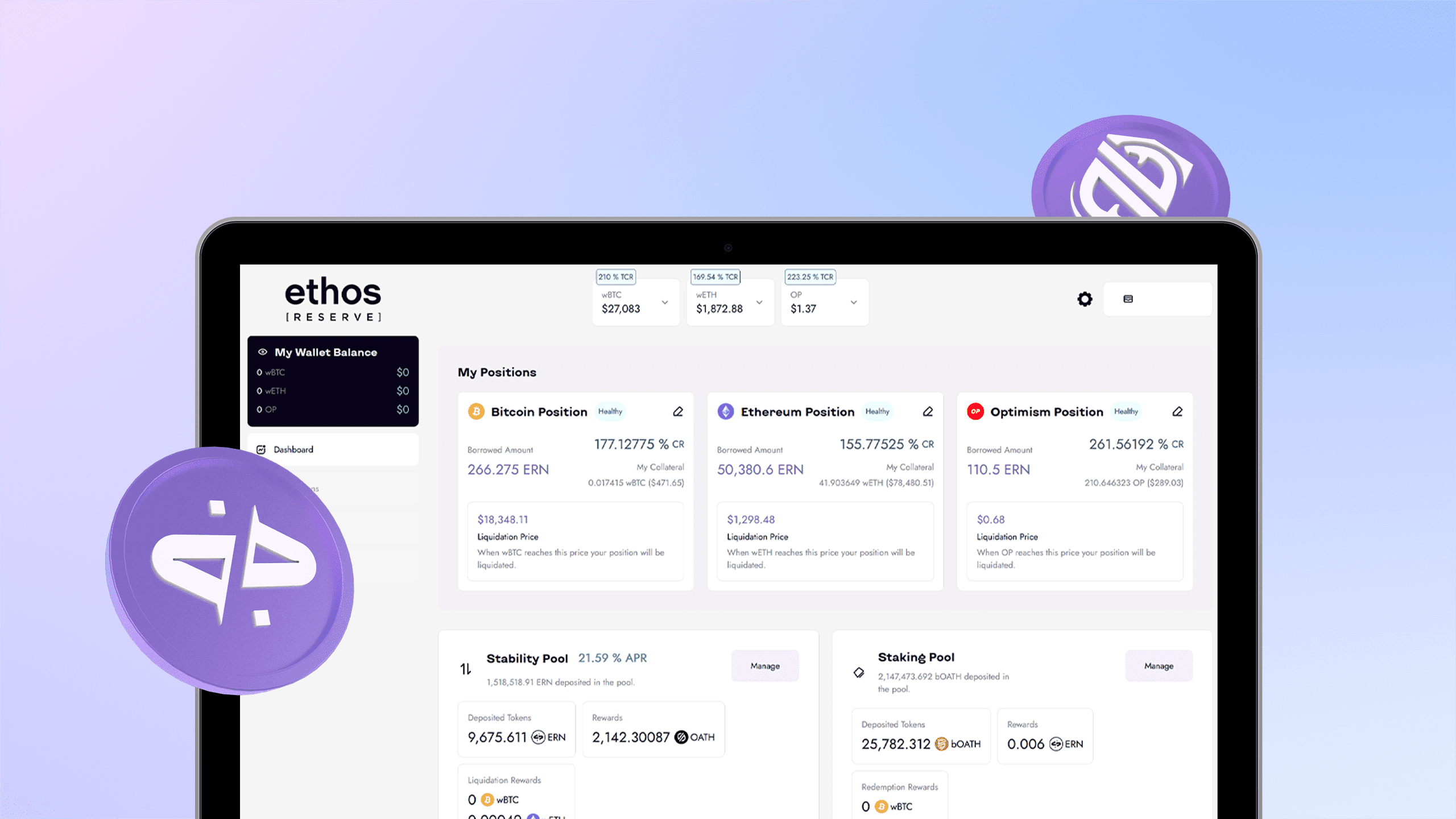

The Ethos Reserve team has been showing off their work for the last few months, and is proud to announce launch is a few short weeks away. A testnet environment will be deployed soon on Goerli as the Ethos crew continues to polish UI and devops. Expect an open beta shortly thereafter followed by world domination.

Our team has been working hard for nearly a year to bring Ethos Reserve to fruition, and believe it has the potential to unlock a new level of sustainability for DeFi. We hope Ethos Reserve sets a new standard for protocol design, focused on upending traditional financial business models without sacrificing their efficiency — distilling premium value and services to the end user.

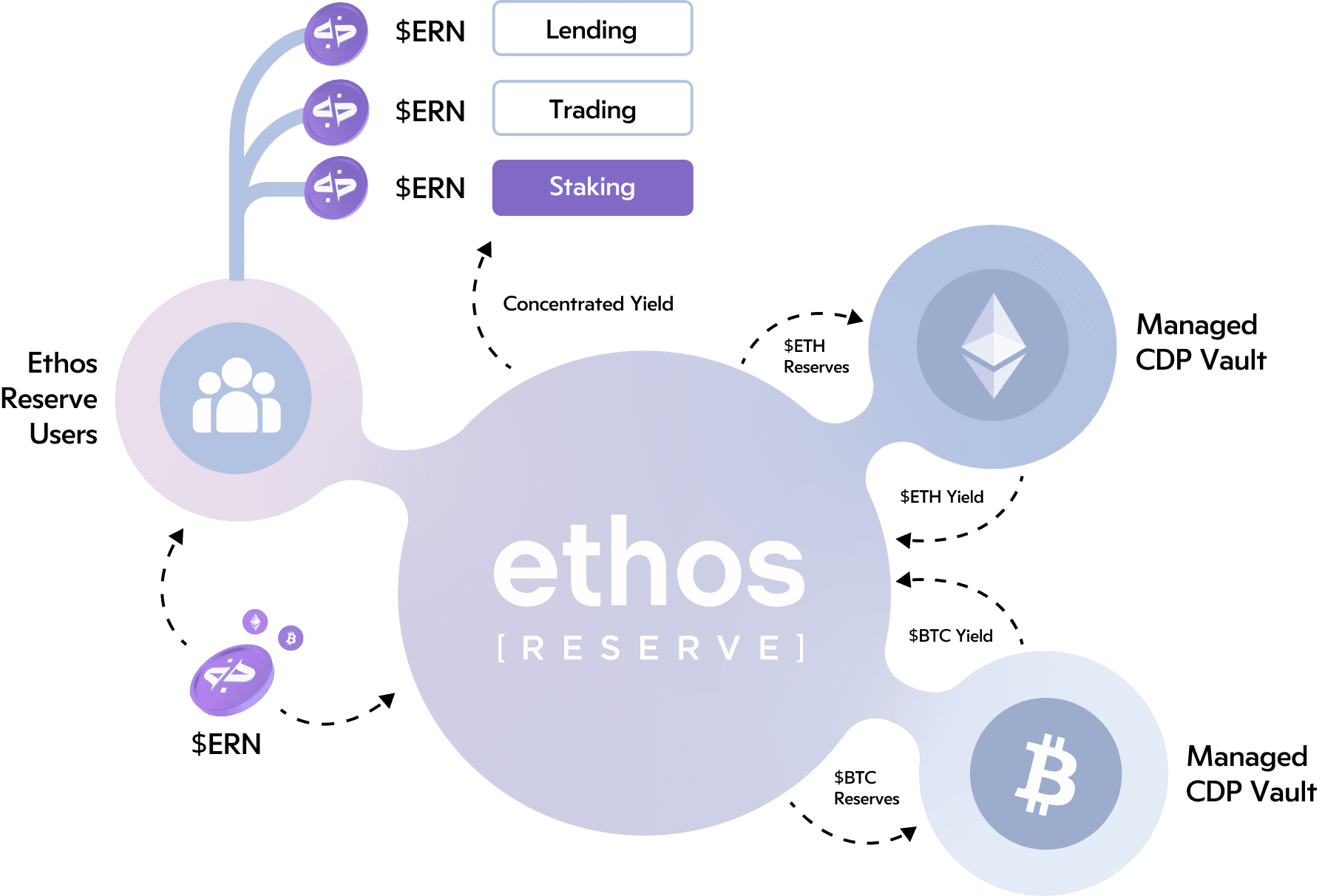

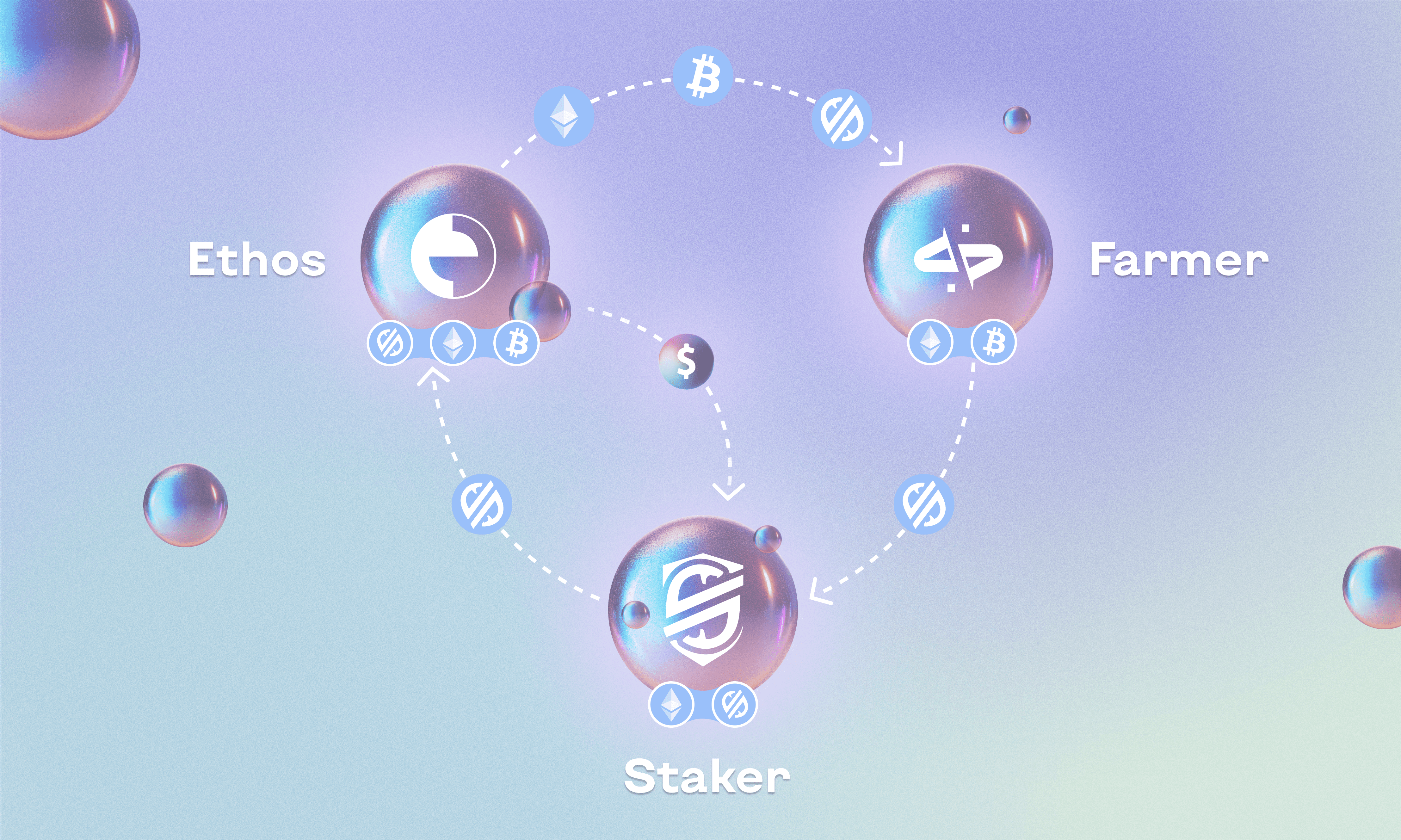

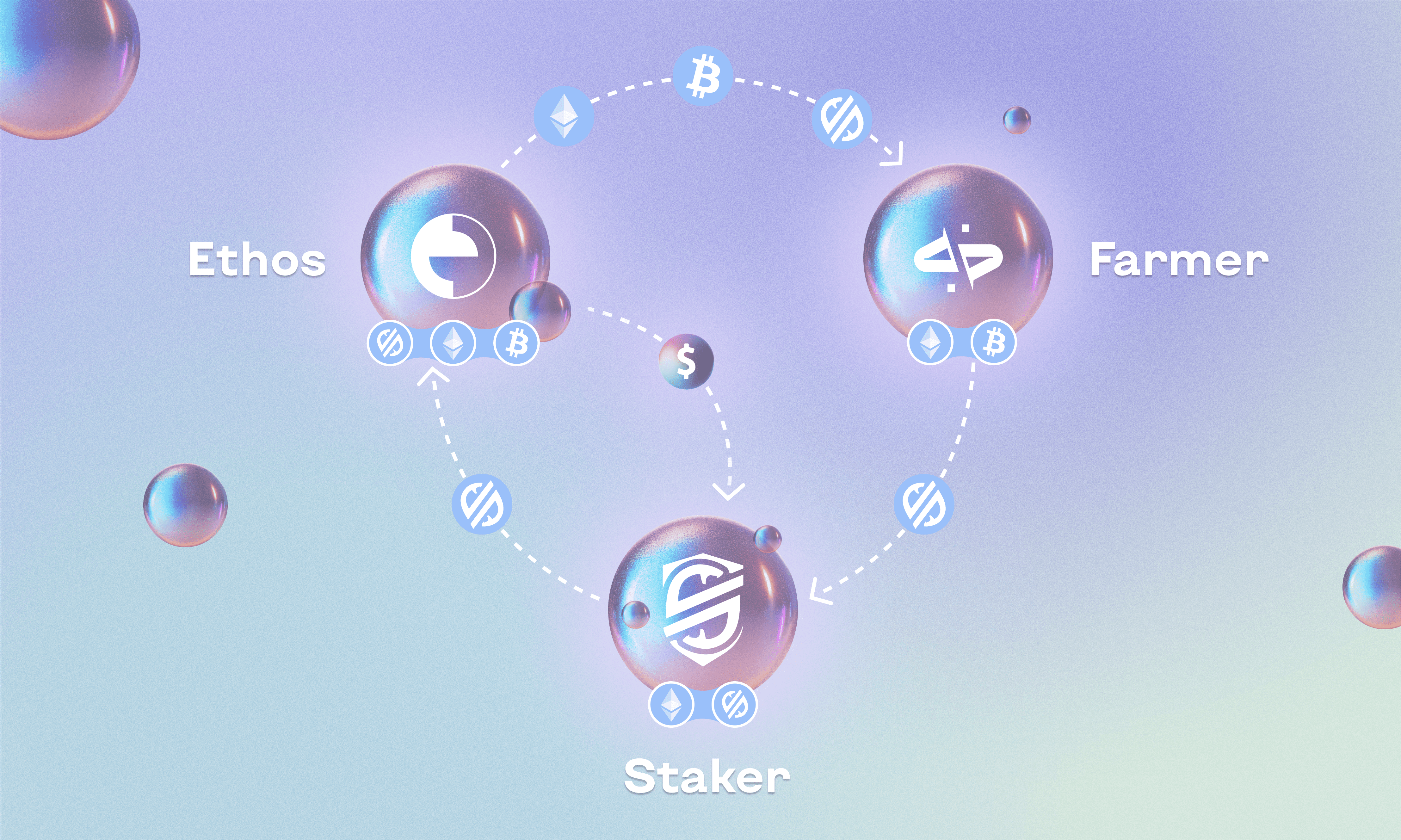

Ethos Reserve is special because it can deploy its underlying assets to DeFi yield strategies, as well as manage their risk and liquidity block-by-block. Users can enjoy highly efficient $ERN loans while deposited assets are put to work in the lowest-risk environment possible. Yield generated by the protocol is directed back to $ERN stakers, who also benefit from liquidation income. This system allows the protocol to take advantage of Ethereum’s low-risk interest rates, resulting in a DeFi system that has the network effects of a liquid staking derivative with highly efficient lending and stable-asset yields built in.

While this may not seem so special, the way Ethos manages debt involves highly complex data structures that allow the protocol to isolate and liquidate multiple collateral types more efficiently than competitors. Additionally, assets can be redeemed right from the protocol, ensuring that users have a right to their assets no matter the state of market liquidity. This combination of features allows for extremely high LTV ratios and additional yield for users. It also removes the need for market-making, as the protocol will always swap under-peg tokens for collateral.

Ethos Reserve is able to issue interest-free loans denominated in the Ethos Reserve Note, or $ERN. Instead of paying interest, users pay a small issuance and redemption fee, which is directed to $bOATH (Bonded $OATH) stakers. Because debt doesn’t continue to accrue after a loan is issued, users don’t need to worry about micro-managing their position and the protocol doesn’t need to worry about bad debt piling up. Issuance and redemption fees also allow $bOATH stakers to derive value from arbitrage and $ERN volatility.

Through these features, stakers will always be earning ($ERN-ing?) the most sustainable stable-asset yield in DeFi, with competitiveness growing as the protocol scales. Beyond its highly efficient liquidations and stabilizing mechanics, $ERN’s long-tail value allows loan-to-value ratios to be pushed very close to 1, giving users powerful new ways to hedge their volatile assets.

Bonded OATH, or $bOATH, is both OATH and ETH, backed by a Balancer-powered 80/20 liquidity pool. $bOATH will not only earn all platform fees, but benefit from trading fees generated by Ethos’ incentive buyback and distribution strategies.

These strategies will create a constant source of demand for $OATH as it buys it back to fund yield. As trade heats up between CDP vaults and $ERN compounders, yield for this pool will naturally increase, adding further to the flywheel effect created by Ethos’ unique architecture and benefiting all stakeholders.

The Ethos Reserve team has forged a sustainable path forward for decentralized stablecoin infrastructure, powered by $OATH. With extensive testing and a full audit now complete, the Ethos Reserve team is getting ready for a new age of DeFi stable assets.