Please note: this is a community article. Content written by community members is not necessarily a reflection of the opinions of Ethos Reserve. We invite you to share feedback and join the community conversations in our Discord.

In the world of finance, it is often crucial to pause and ask ourselves ‘why are things the way they are?’ before envisioning how they could be better. Collateralized debt, a cornerstone of traditional finance (TradFi), deserves such scrutiny. Why is it so important? Can the decentralized finance (DeFi) approach offer a superior alternative, or are we merely forging Collateralized Debt Position (CDP) protocols because we have the technological means to do so?

In this exploration, we will focus on the fundamental question of why collateralized debt matters. We will dissect collateralized debt in both TradFi and DeFi, exploring their differences, limitations, and the potential for a safer, more equitable future.

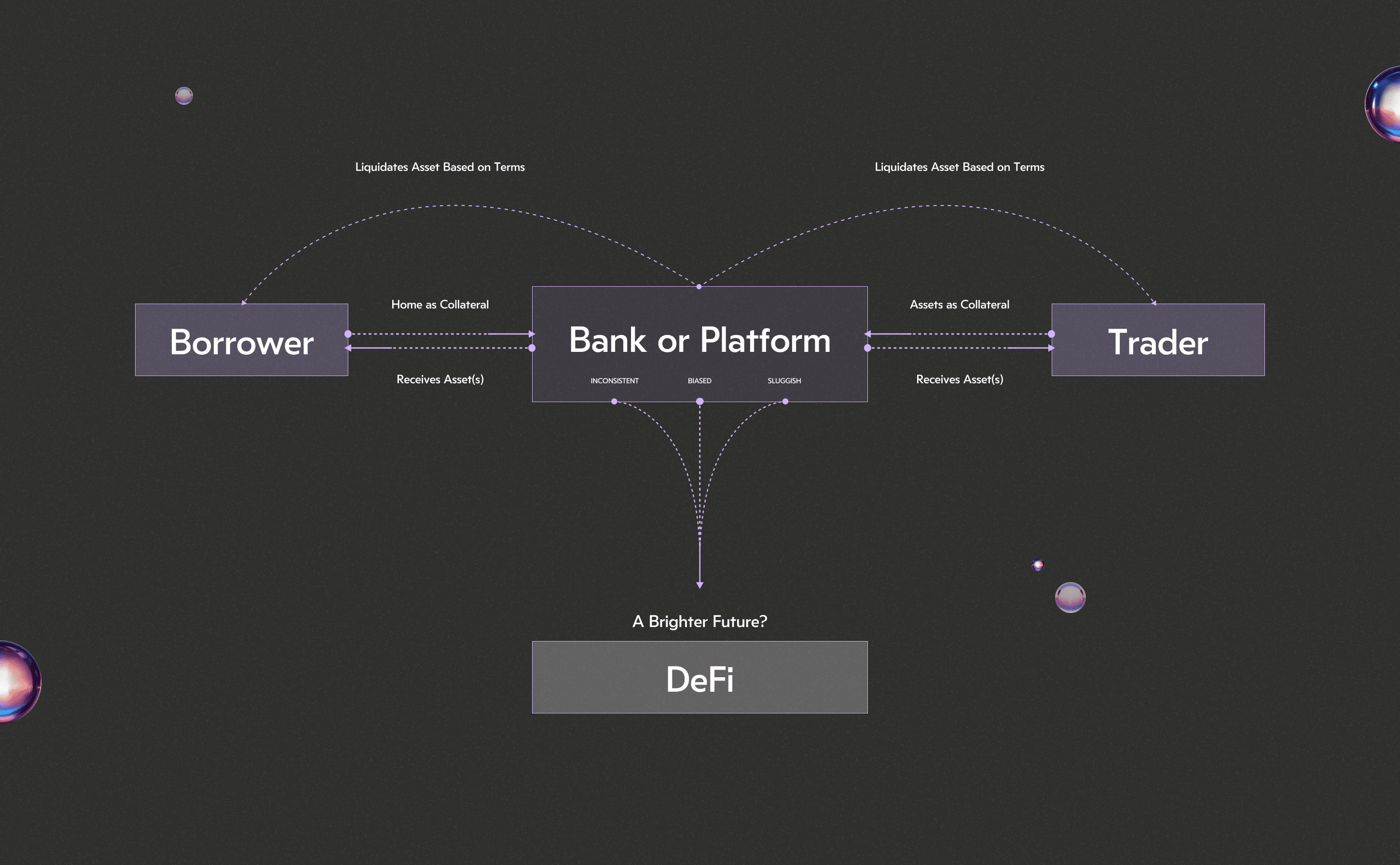

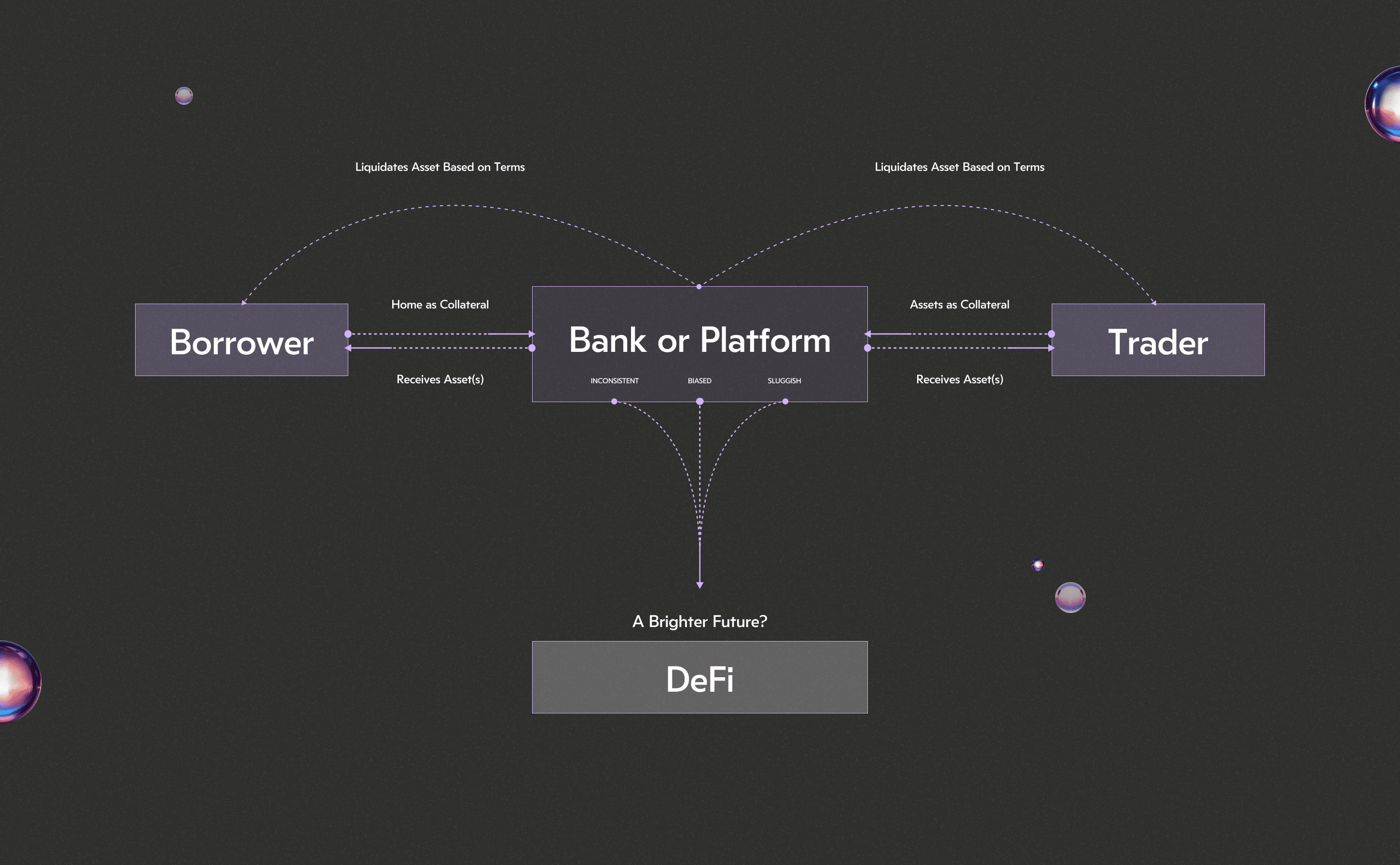

TradFi has long utilized the concept of collateralized debt. In the financial world, collateral is a valuable asset that a borrower pledges as security for a loan. In most cases, the lender will define loan conditions based on the risk they are assuming.

For example, when a homebuyer obtains a mortgage from a bank, the home serves as the collateral for the loan. If the homebuyer defaults, the bank can seize the home and sell it to recoup the loss.

In the homeowner’s case, the bank will assess the buyer’s income and overall ability to repay the loan. Since homes are an illiquid asset, it can be very costly and tedious to repossess and sell a home, so it is in the bank’s best interest to structure the loan such that the homeowner can make their repayments, while the bank stays profitable.

Another example is margin trading, where a trader posts the value of their margin account as collateral and borrows funds that they can spend on purchasing more shares. This increases their exposure to desired assets, thus leveraging their investment positions.

In this instance, the lender can very quickly seize and liquidate assets, so they may offer better debt-to-collateral ratios. They may not want exposure to collateral for very long, so will offer efficient loans but with high interest rates, to compel traders to repay their debt quickly.

Essentially, there are many ways to structure debt issuance relative to collateral to suit use cases, and compete for usership (and thus profit), while managing risk. What is important is that the value of the collateral is unlocked without sale. The homeowner can access the value of their home, and the trader can access the value of their portfolio, without selling their assets. On a large scale, this frees up a significant amount of liquidity, driving tremendous economic growth (when used correctly).

TradFi has progressed further to securitize debt in the form of products like Collateralized Debt Obligations (CDOs), Collateralized Loan Obligations (CLOs), etc. These will not be discussed in detail here, but the point remains that collateralized debt is an incredibly powerful tool that can be harnessed, ideally for good.

By far the greatest limitation of TradFi collateralized debt is subjective variability. Debt conditions in TradFi continually vary in their offerings (interest rates, debt to collateral ratios, etc.). Conditions change weekly with economic and geopolitical context, and consistency is never guaranteed. From a service perspective, debt conditions vary based on the borrower’s age, profession, and even race or gender in some cases. Debt is constantly assessed subjectively, governance is tiresome, and brokers are only available at their own leisure. To cap it all off, traditional finance infrastructure requires buyers and sales processing in order to liquidate collateral. The entire process is extremely convoluted, with a myriad of avenues for moral deviation.

The result is a corporate powerhouse of profit maximalism, that with so many layers of human governance, is subject to corruption and malicious predation. Perhaps the finest example of collateralized debt gone awry is the Global Financial Crisis (GFC) of 2007–2008.

The GFC was fueled by collateralized debt, primarily products derived from collateralized debt, such as mortgage-backed securities (MBS) and CDOs. In short, the housing bubble, driven by subprime mortgages bundled into complex financial instruments, burst when home prices declined and borrowers defaulted. Rating agencies’ flawed assessments and widespread financial institutions’ investments in these securities exacerbated the crisis. Many financial institutions collapsed, while others were bailed out by federal government intervention. Meanwhile, millions of innocent families lost their homes, their savings, and their livelihoods.

The interconnectedness of the financial system caused the GFC to spread globally, leading to a severe economic downturn, and the lack of transparency and over reliance on subjective credit ratings were critical factors in the collapse. Details of the GFC are far more elaborate, but this summation serves to highlight the inevitability of collateralized debt, and the ramifications of corrupted misuse.

At the risk of oversimplifying, or perhaps just stating the obvious, a better approach may be to assess risk objectively and algorithmically, and liquidate efficiently and transparently. Offer the same service, to everyone, at all times, and in all market conditions, without bias or predation.

DeFi has introduced the concept of a CDP, where users post collateral and borrow an asset that represents their debt. In the case of Ethos Reserve, users can deposit premium collateral such as Bitcoin (BTC), Ethereum (ETH), and Optimism (OP) tokens, and mint Ethos Reserve Notes (ERN) to represent the debt they owe.

Users may do as they wish with their ERN, and eventually pay it back, to have your collateral returned to you. Most, if not all, CDP protocols in DeFi work in the same fashion. This is an extremely important concept because, much like in TradFi, it allows users to leverage the value of their assets without selling them.

This is most similar to the margin trader described above.

Let’s say the margin trader owns shares worth $100. They want to put that $100 to work, but don’t want to sell the assets.

Instead, they post them as collateral to borrow $80, unlocking the value of their assets without selling the original $100. If the value of the shares increases, the trader only needs to pay back $80 (plus interest) to get their original shares back. If the value of the shares drops, the lender may sell them to recover their $80+. Typically they will sell them before they reach $80, to protect their own capital (risk management), but this gap will be clearly articulated.

Either way, the sale of shares is postponed, and the trader gets access to more capital.

An important distinction between DeFi and TradFi is that, unlike banks, Ethos Reserve and other CDPs do not have millions of dollars to hand out, so they hand out assets that represent dollars, and then ensure that those assets are worth $1 each (ERN in the case of Ethos Reserve).

Since ERN represents debt owed, it is extremely important to protect its value. If the value of collateral drops, the system must recover the value of debt owed, to remain sufficiently collateralized. For this, Ethos employs advanced, automated liquidation mechanics, with additional layers of protection, to protect the value of debt in the most dire situations.

You can read more about these mechanisms in Ethos documentation, but, for now, all you need to know now is that they work extremely efficiently and without case-by-case subjectivity.

DeFi solves many of the fallacies of TradFi. CDP protocols handle debt and collateral algorithmically, offering the same conditions to every user, automatically and without bias. They offer the same numbers; debt-to-collateral ratios, loan specifications, etc., to their users, no questions asked. This is why CDPs matter.

Perhaps more importantly; this extends philosophically. CDPs embody fairness, programmed to always offer the same service (within legal boundaries), regardless of a user’s background or professional network. Users do not need permission, assessments, or opening hours, to access the value of their collateral. This is also ‘why’.

Lastly, and most critically, where traditional finance requires valuations, buyers, and sales processing, DeFi liquidates assets instantly and transparently. There are no subjective credit ratings and opaque debt products carrying systemic risk. DeFi systems defend themselves from bad debt automatically and without hesitation. As DeFi expands and finds use cases to replace TradFi or bring traditional assets and functions on-chain, the consistent and inevitable fallacies of TradFi will continue to present themselves as ‘why’.

Ethos Reserve is a decentralized lending protocol that allows users to take out interest-free loans against collateral such as BTC and ETH. Loans on Ethos Reserve are paid in Ethos Reserve Notes (ERN), a stable asset pegged to the US Dollar. Collateral backing ERN is used to generate passive yield, which is directed toward Stability Pool depositors. These depositors secure the protocol against unhealthy collateral by depositing their ERN tokens into a pool which liquidates unhealthy positions within the system.

Ethos Reserve is a decentralized lending protocol that allows users to take out interest-free loans against collateral such as BTC and ETH. Loans on Ethos Reserve are paid in Ethos Reserve Notes, or ERN, which is a stable asset pegged to the US Dollar.

Loans drawn from Ethos Reserve require users to maintain a minimum amount of collateral in the system to cover their debt. These collateral ratios are as low as 108% for ETH, 110% for BTC, and 130% for OP, and may be lowered over time depending on usage.

Collateral backing ERN is used to generate passive yield, which is directed toward Stability Pool depositors. These depositors secure the protocol against unhealthy collateral by depositing their ERN tokens into a pool which liquidates unhealthy positions within the system.